The following article may contain affiliate links or sponsored content. This doesn’t cost you anything, and shopping or using our affiliate partners is a way to support our mission. I will never work with a brand or showcase a product that I don’t personally use or believe in.

How to Save Money on Groceries

According to USA Today, over $4,000 is spent every year per household on groceries alone.

It’s one of the biggest fixed expenses in your budget. And it’s non-negotiable because, well, you kinda have to feed yourself.

Spending money on groceries to cook meals at home is almost always cheaper than going out to eat. I’ve made a significant effort so far this year to cut back on eating out – not only for my waistline but for my wallet. And when it comes to cooking for yourself and buying household items, there are ways to optimize that too.

Food and household spending are some of the few areas where you can make significant adjustments to the budget. With some minor changes and clever tactics, you can spend a whole lot less.

Here are 5 ways to save on groceries and household items:

1. Shop at the back of the store

When I go to a physical store to shop (gasp, I know), my favorite part is the discounted section in the very back of the store. It’s usually two horizontal racks by where employees go in and out, filled with goods that have been discontinued or are about to expire. The items are often 50% off — I’ve scored cookie mix, tea, and spices — and it’s worth a trip to the back corner to go sleuthing. It feels like a treasure hunt, as there are never the same things twice.

2. Get a store rewards card

This may seem like, “no duh”, but you’d be shocked at how many people still haven’t signed up for free rewards. Store rewards cards not only give you points you can use for your next purchase, but they also give you discounts on other items, coupon offers, and even gas rebates. You can get the items you need without paying full price, and also get basically free money later. I love my Safeway card — not only does it get me discounted prices on everyday items, but it also saves me extra money on things I buy often (called “Just4U”) and a gas discount at Chevron. I can fill up my tank, often for 30 cents less per gallon.

3. “Cost per” pricing

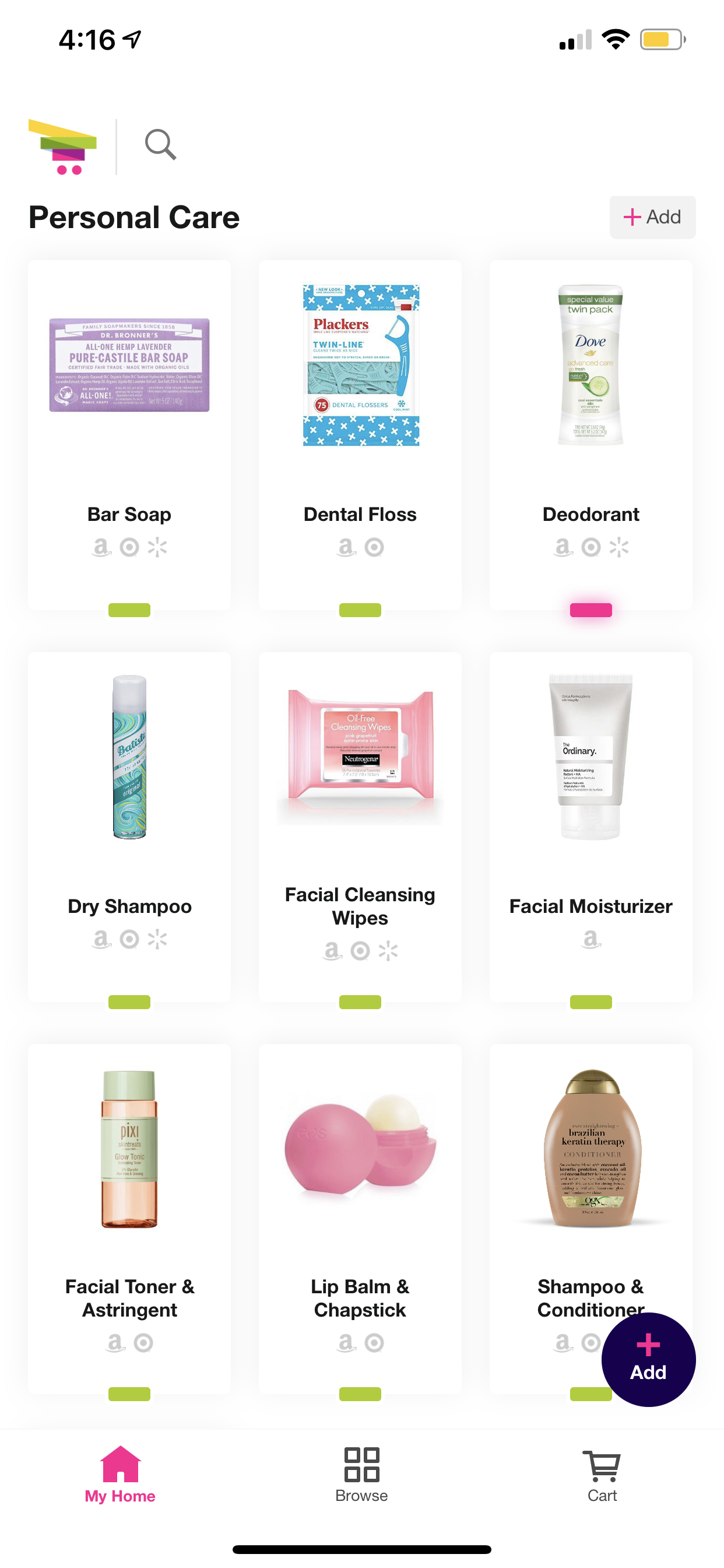

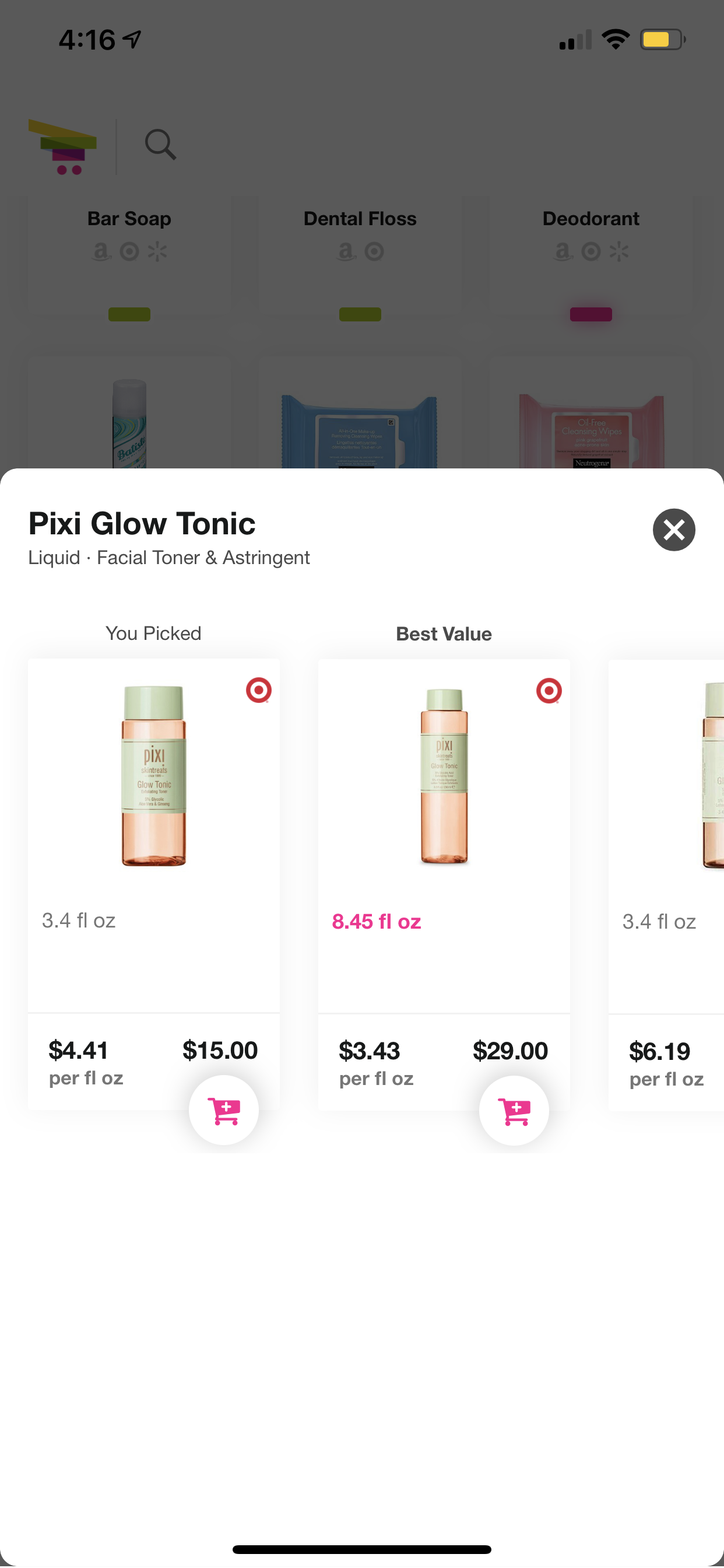

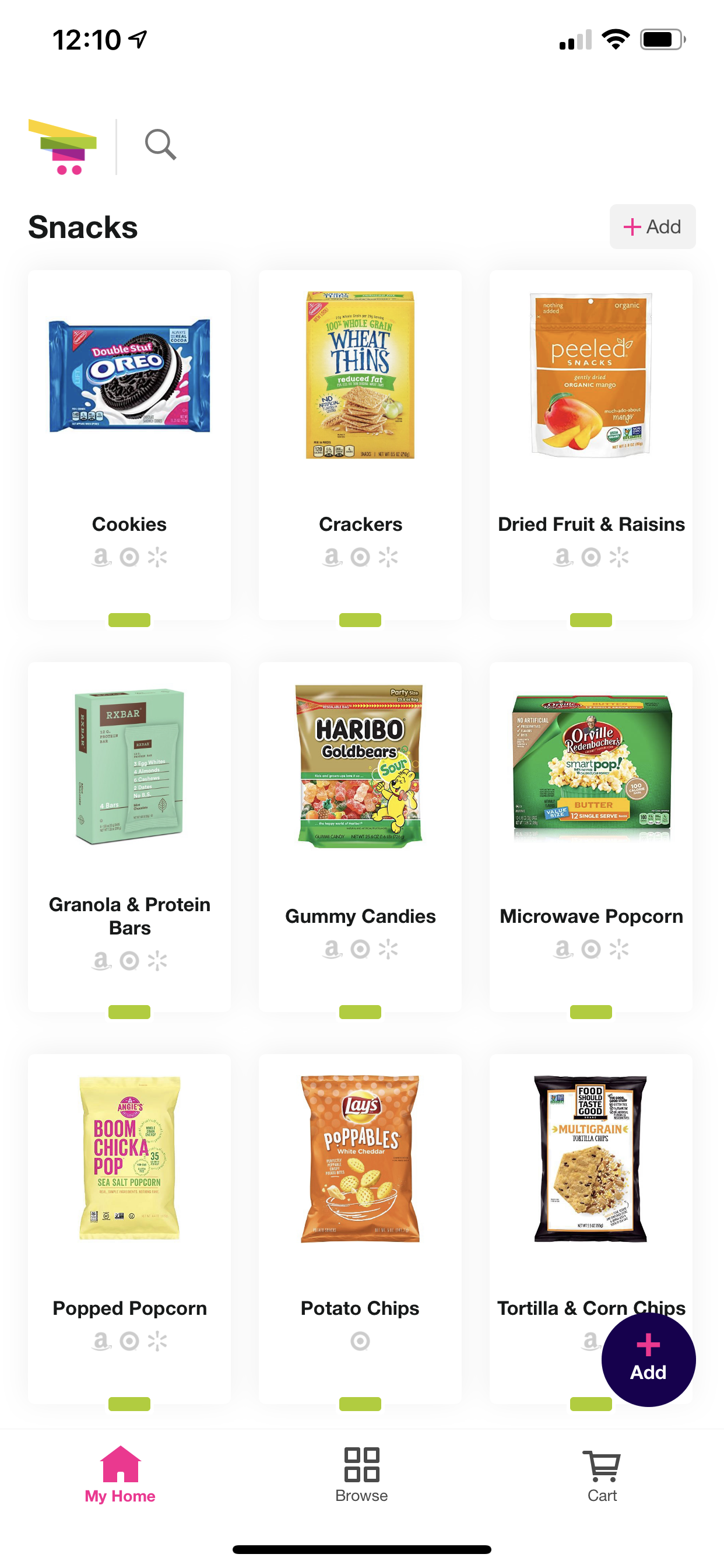

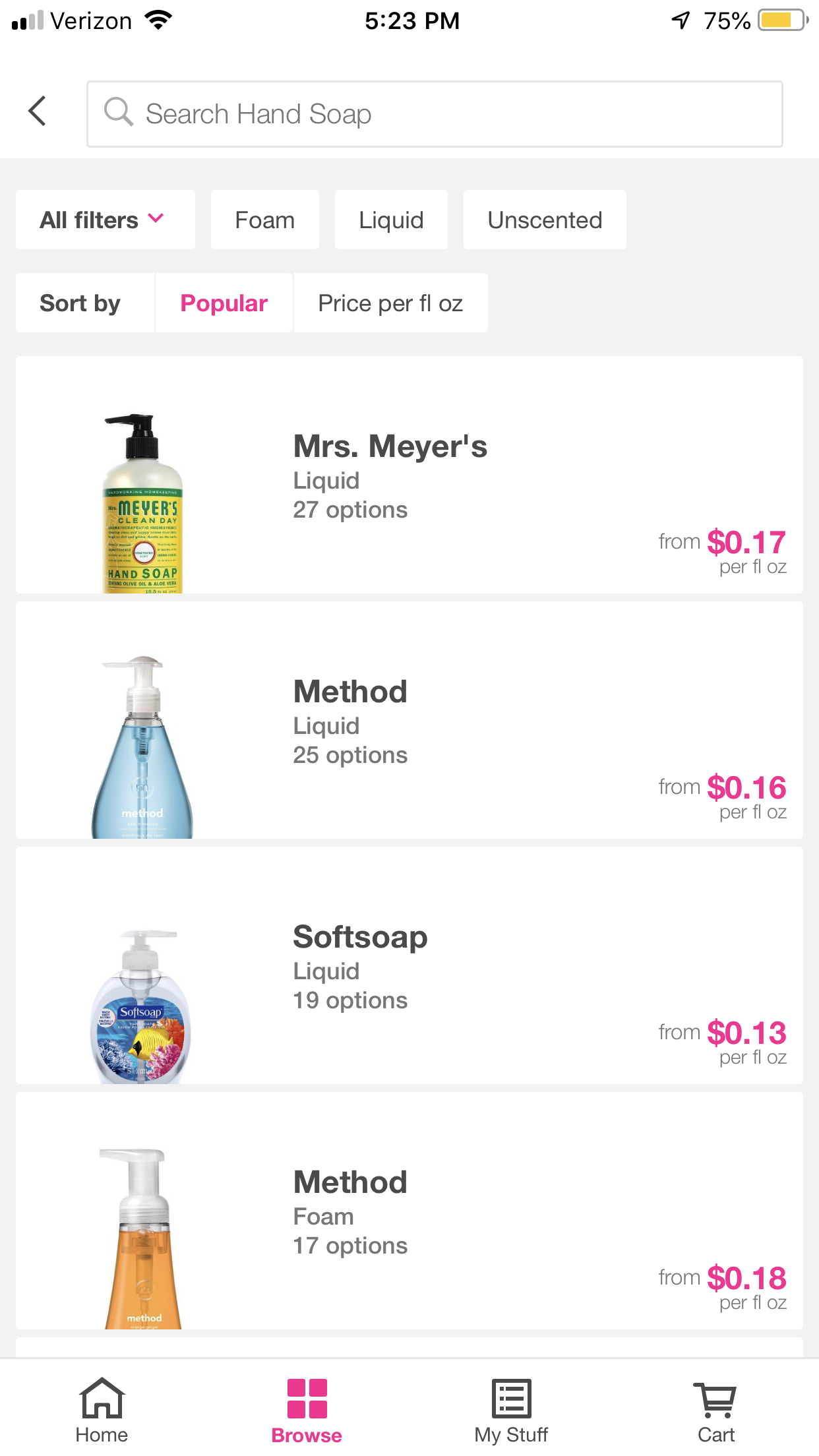

When I was growing up, I went grocery shopping with my mom every week. She taught me the art of shopping and gave me an incredible piece of advice. Never look at the sticker price, but instead look at the cost per pound or ounce. This works with everything: spices, cereal, even toilet paper. By looking at the “cost per” as opposed to the sticker price, you’re making sure you get more product and a better value. But when you’re shopping online, there are a million brands to choose from and dozens of stores to shop from (Amazon and Walmart, I’m looking at you.) Without the product in front of you, it’s hard to determine the price per pound. Cue Popcart.

Popcart makes comparison shopping smarter. It helps you find all the stuff you need — from diapers to coffee pods and sparkling water — at a “per X” price. If you’re comparison shopping for makeup wipes, for example, Popcart can show you the cost PER wipe from various different stores. Seriously. Without having to spend more on gas, or the energy to go through all the aisles to find what you need, Popcart is my new go-to tool for smarter shopping, and getting every bit of value from my purchases.

4. Imperfect Produce

Imperfect fights food waste by finding a home for “ugly” produce that is still perfectly tasty. They source it directly from farms and deliver it to customers’ doors for about 30% less than grocery store prices. I’ve been a customer for the past year and absolutely love the ability to customize my box (it’s usually 4 heads of cauliflower lolz). Here’s $10 off your first box if you’re interested!

5. Buy In Bulk

Buying in bulk has an advantage. You save money because buying more than a few items means you can purchase it at bulk prices. I’ll often stock up on things that I know I’ll need later that are on sale now — I have 3 bottles of shampoo, a huge box of pasta, and cans of soup ready to go in my closet (y’all know how much I love Costco.)

The idea of bulk buying isn’t new. The theory is that the more you buy an item, the less it will cost because you’re grabbing up most of the stocked items. But when you live alone, as I do, buying in bulk can be tricky, as you don’t want things to go to waste. As with all grocery items, check the packaging for the best before or expiration date so you know how long it will be best to keep. And if you’re worried about not being able to use it all in time, only buy non-perishables in bulk.

Other random tips:

-

If you shop at a physical store, ask someone at the meat and fish counter when things get delivered. If the delivery day is Tuesday, you better believe they’re slashing their prices the night before.

-

When using Popcart, add things you buy frequently to your “list” in the app to make reordering easy.

-

Don’t shop hungry, online or offline. You’re more likely to purchase more food when you’re ravenous.

Do you have some tips on how to save money at the grocery and household shopping? Tell me below. And if you love Popcart as much as I do, tweet me!

This post was sponsored by Popcart, but as always, all opinions are my own. I will never partner with a brand or organization I do not personally use or believe in.

RESOURCES

I get asked all the time: what are your favorite money management tools?

Chase Freedom Unlimited: My go-to travel and dining rewards card that I recommend.

Deserve: The card I recommend for building credit.

Treasury: We’re building a one-of-a-kind, non-judgemental community where you can learn exactly how to invest, build wealth, and receive exclusive access to Her First $100k.

Personal Capital: The tool I check daily, Personal Capital is the best tool for tracking your net worth and your progress towards goals like saving, debt payoff, and (yes!) $100K.

The $100K Club Facebook Group: Need some honest money conversations in your life? Join my free community to get your burning questions answered.

Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.